Due to the discontinuous, unstable, and uncontrollable characteristics of renewable energy generation such as wind and solar energy, large-scale integration of renewable energy into the power grid will have a serious impact on the safe and stable operation of the power grid.

Applying energy storage to the field of power transmission and distribution, participating in frequency regulation, voltage support, peak shaving, reserve capacity reactive power support, alleviating line congestion, delaying power transmission and distribution expansion and upgrading, and serving as a DC power supply for substations can well ease the integration of new energy sources into the grid. brought about a series of problems.

Market prediction

Based on forecasts from CPIA, EASE, Wood Mackenzie, EIA and other institutions, the global energy storage market will maintain high growth in 2023. It is estimated that global installed capacity is expected to reach 120.4GWh in 2023, and will continue to increase to 201.8GWh and 313GWh in 2024-2025, with a CAGR of 65.0% in 2021-2025.

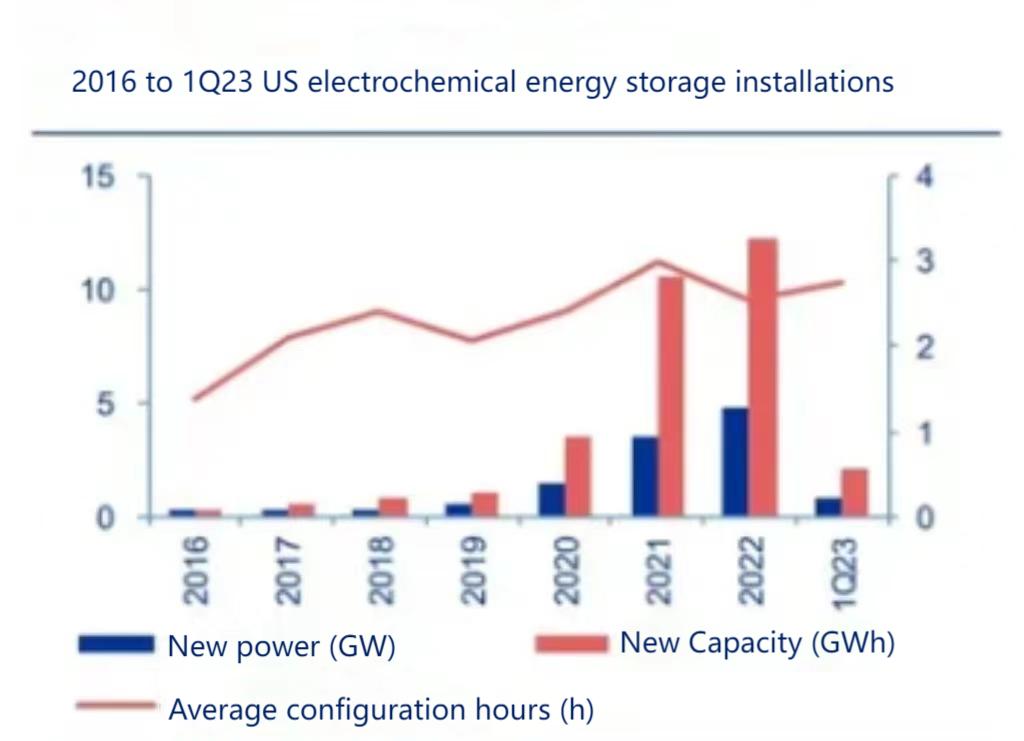

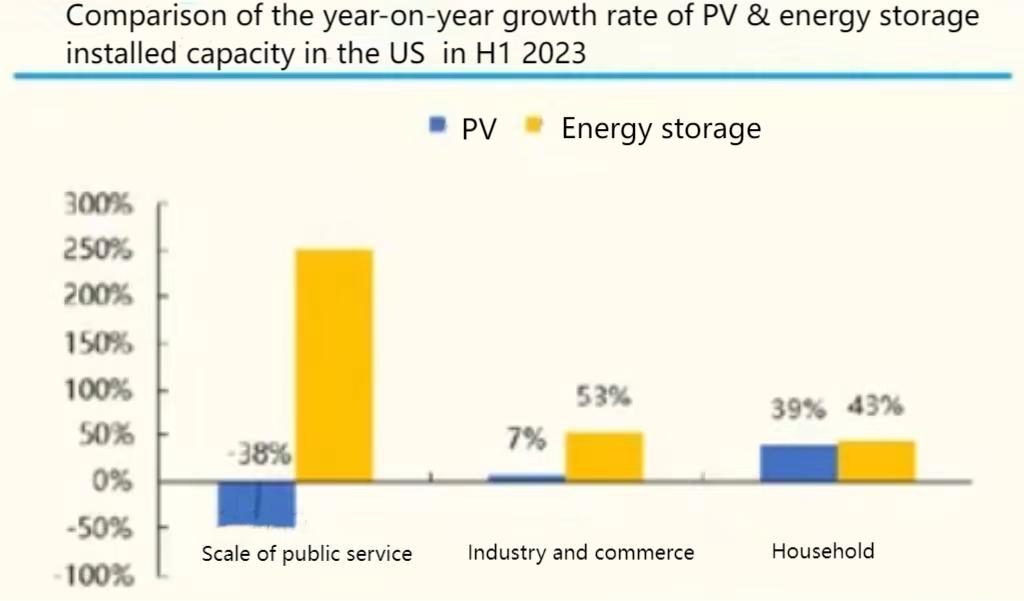

The United States is the world’s largest and fastest-growing energy storage market. According to statistics from Wood Mackenzie, the newly installed capacity of electrochemical energy storage in the United States will reach 4.80GW/12.2GWh in 2022, a year-on-year increase of 37%/16%, with new power and capacity reaching new highs. In 2023Q1, the newly installed capacity of electrochemical energy storage in the United States reached 0.78GW/2.15GWh, a year-on-year decrease of 19%/25%, mainly due to the delay of installed capacity and grid connection projects. In terms of installed capacity characteristics, industrial and commercial energy storage and household energy storage have few restrictions on grid connection, and the project progress is normal, with both expansion in 2023Q1.

Driving factor

The main driving factors for the rapid development of industrial and commercial energy storage and household energy storage in 2023 are:

1)Affected by geopolitical conflicts, the energy self-sufficiency rate is low; electricity prices continue to rise, which promotes the rapid increase in household savings penetration rate. 2)Most buildings in the United States are low-floor independent buildings, and energy storage installations are easy to construct and easy to install.3)Portable energy storage is mainly used in European, American and Japanese countries. Outdoor culture is prevalent, and the geographical environment of some areas makes locals tend to prepare power in advance.

Feature

1. The growth structure of energy storage in the United States is strongly correlated with photovoltaics. The market before the meter accounts for more than 80%, and the market after the meter is dominated by households.

2.The energy storage installed capacity in the United States is mainly distributed in areas with large photovoltaic installed capacity, with California, Florida, and Texas being the top three states with power shortages. California and Texas are the main markets for electrochemical energy storage in the United States.

California occupies the highest market share in the United States in the field of energy storage due to the Self-Generation Incentive Program (SGIP). It is used to encourage user-side distributed power generation, including wind power, fuel cells, energy storage and other technology types. SGIP will provide 75% of incentive funds for energy storage, and plans to add 15GW of front-meter energy storage in the next ten years.

Texas ERCOT is a relatively independent regional power grid in North America. It is only connected to other power grids by about 1,250MW of power flow controllable DC lines. Texas has many large-scale photovoltaic power stations and wind farms, which requires more reliable adjustable energy storage resources to enter the power system. In 2022-23, Texas’ electric power load hit record highs many times in a row. Therefore, energy storage development has formed a consensus in Texas, and many energy storage projects under construction will be completed in the next few years.

3.In 202208, the President of the United States officially signed the “Inflation Reduction Act IRA”, which included independent energy storage greater than 5KWh into the ITC exemption policy, releasing more application scenarios for energy storage. The U.S. government’s support for the sustainable energy transition is huge and will begin to explode in 2023.

After the implementation of the IRA Act, the independent energy storage LOCS is about 39.5-61.6 US dollars/MWh, the IRR is about 16.5-38%, and the economic efficiency has been greatly improved; the cost per kilowatt-hour of photovoltaic + energy storage power stations has been lower than that of natural gas power generation.

4.In the behind-the-meter market, the increase in residential electricity prices coupled with the increase in the ITC credit ratio will further stimulate the economic improvement of household energy storage. The average storage time for household energy storage is stable at 2.2-2.4 hours, and Wood Mackenzie statistics are expected to rise slightly as costs fall.

In addition, affected by the decline in global lithium carbonate prices and the large-scale launch of new production capacity of lithium battery materials, the prices of major materials will decline in 2023H1. According to Xinluo Consulting data, the price of 16um dry separator/lithium iron phosphate cathode/lithium iron phosphate electrolyte/mid-end artificial graphite in 2023 will fall by 24%/49%/71%/30% from the high point in 2021.

According to SMM data, the price of square lithium iron phosphate batteries (energy storage type 280Ah) is about 0.55 yuan/Wh, which is about 0.98 yuan/Wh in December 2022, a decrease of 0.43 yuan/Wh.

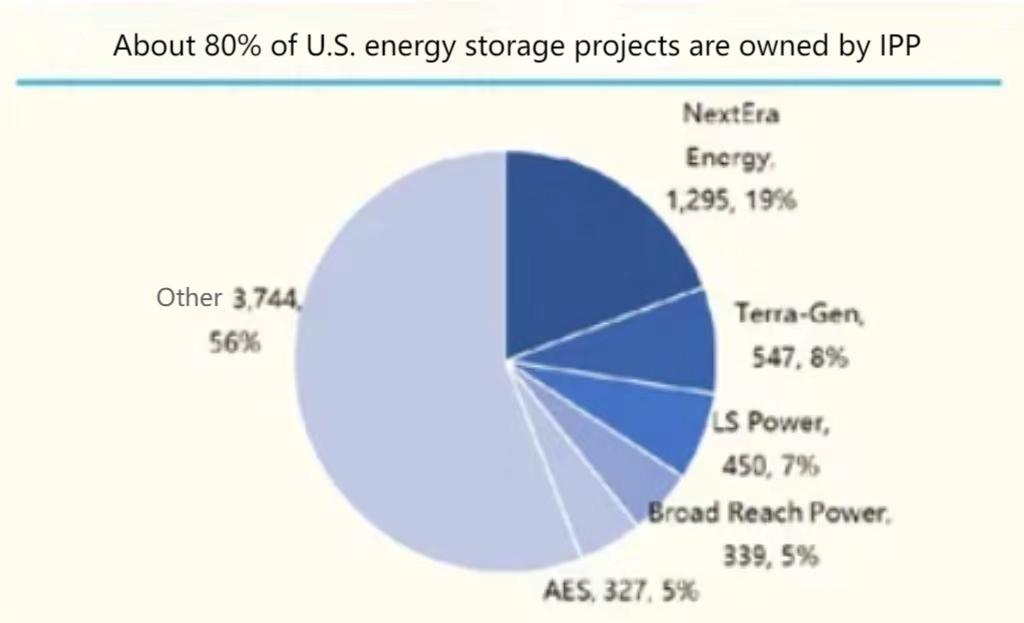

U.S. front-of-meter storage is mainly developed by electric power generation companies and constructed according to a project system. Energy storage system manufacturers participate in specific projects as integrators or co-builders.

To sum up, it is expected that the installed capacity of large storage capacity in the United States will explode from 2023 onwards. To learn more about the lithium battery industry, stay tuned for more updates on the website or follow MK Energy’s social media accounts.