After long-term development, the lithium battery industry has formed a closed-loop system from upstream basic raw material mining – midstream manufacturing and packaging – downstream terminal application and recycling.

However, due to the high degree of specialization of the industry itself and the detailed and clear division of labor, any small variable in the supply chain may affect the whole body. Therefore, enterprises at all levels of the industrial chain need to be more cautious, follow up the latest developments in lithium batteries in a timely manner, and seize development opportunities.

Reserves and Production

Typical representatives of cobalt, lithium, nickel, manganese, graphite, etc., the basic raw materials of lithium-ion batteries determine the “throat” of the fate of the entire lithium battery industry chain, and having abundant lithium reserves is very important to ensure the stable operation of the lithium battery supply chain.

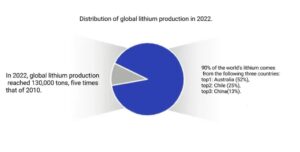

According to the data of the US Geological Service, due to the continuous exploration of human beings, the currently identified lithium resource reserves in the world have increased significantly, totaling about 98 million tons.

The country with the most abundant lithium resource reserves in the world is Bolivia, which has proven lithium resource reserves of 21 million tons in 2022, accounting for more than 20% of the global lithium resource reserves, followed by Argentina with reserves of about 20 million tons.

Reserves and production capacity together can lay a solid, reliable and safe technical foundation for the long-term development of the lithium battery industry.

High demand for lithium battery

With the impact of energy shortage, green and low-carbon and other global factors, the wave of energy revolution has driven the demand for lithium battery industry to increase rapidly in various application scenarios, including: consumer electronics (smartphones, tablets, smart bracelets, etc.), power (Electric bicycles, electric vehicles, etc.), energy storage fields (grids, data centers, 5G base stations, etc.).

It is estimated that the compound annual growth rate of global demand for lithium resources can reach more than 30%. Data show that in 2022, the newly installed capacity of global energy storage will hit a new high, reaching 20.5GW/42.1GWh.

As the world’s largest large storage market, thanks to the sufficient amount of energy storage records and the implementation of the ITC tax credit policy, the industry predicts that the demand for energy storage in the United States will show a high growth trend. According to Wood Mackenzie’s data, from the first quarter to the third quarter of 2022, the newly installed capacity of energy storage in the United States reached 3.57GW /10.67GW, of which, the newly installed capacity in the third quarter was 1.44GW/5.19GWh, a year-on-year increase of 27%/48%, an increase of 23%/99%.

Soaring energy prices and unstable supply chains have led to a blowout growth in European demand. In May 2022, the European Union launched the RE Power EU plan to accelerate its green transformation, which also stimulated the growth of energy storage demand to a certain extent.

It is estimated that the new demand for energy storage in 2023-2025 will be 30GWh/104GWh, a year-on-year increase of 113% in 2023, and the compound annual growth rate in 2022-2025 will be about 93.8%.

Battery business development

Pay attention to the cooperative customers of battery enterprises and supporting hot-selling models.

The increase in sales of electric vehicles will drive the increase in the installed capacity of related battery suppliers, and changes in the sales ranking of related models will also affect the changes in the installed capacity and ranking of related power battery companies. At the same time, hot-selling models are also more concerned by the market, which has a major impact on the future growth of battery companies’ installed capacity.

As battery companies “compete” for cooperative customers and matching hot-selling models, the battery market structure will “mobilize the whole body”.

Accelerate the deep binding between car companies and lithium battery companies.

At present, leading car companies are stepping up the layout of the global supply system to cope with the release of future production capacity. In order to ensure supply stability, low cost and high quality, car companies around the world – lithium battery companies will be deeply bound.

The industry pointed out that companies that enter the supply system of global core car companies will gain deterministic and high-growth development opportunities.

Power the energy storage industry

Affected by the energy storage trends in China, the United States and Europe, the energy storage industry, which is still in its infancy, has a broad space for development. GGII data shows that in 2022, China’s energy storage lithium battery shipments will be 130GWh, an increase of 1.7 times.

With the superimposed influence of demand, technology and policy, the high cost as the biggest constraint factor for the promotion of lithium battery energy storage will be overcome, which will further promote the growth of lithium battery energy storage.