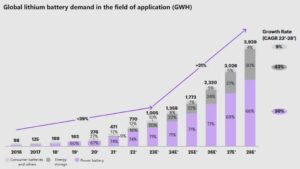

Since the commercialization of lithium batteries at the end of the 20th century, technology and industrialization have continuously developed, and applications have gradually expanded from the consumer field to new areas such as power and energy storage. The increasingly refined downstream application scenarios have different performance and cost requirements for batteries.

Power battery:

Driven by the global vehicle electricity trend, power batteries have become a key application area for lithium batteries, and market demand in the future still shows a high growth trend. However, at the same time, the application requirements of power batteries are constantly refined, and the mainstream and low -end passenger car scenes pursue better range and charging efficiency under the control of cost control conditions; high -end luxury cars, off -road vehicles, electric aircraft and other applications are sensitive Lower degrees, pursue extreme energy density; application scenarios such as low -end A00 electric vehicles and two -wheeled vehicles pursue lower -cost battery solutions.

Energy storage batteries:

The demand for energy storage systems such as new energy grid peak adjustment and peak and valley arbitrage shows explosive growth. In the future, market demand will maintain an annual growth rate of more than 40%. It is the fastest downstream application of lithium batteries. Energy storage batteries are low in volume and weight but have a clear but economical orientation, and pursue a battery solution with low cost and high -cycle life.

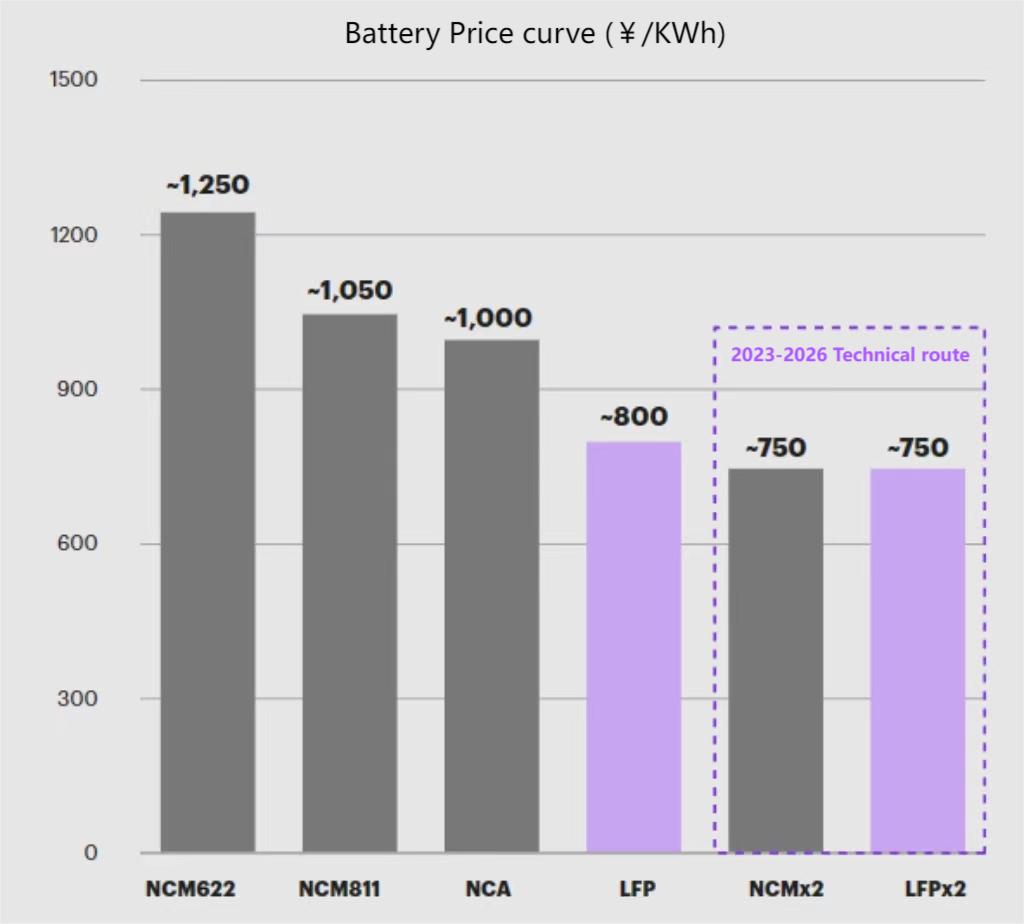

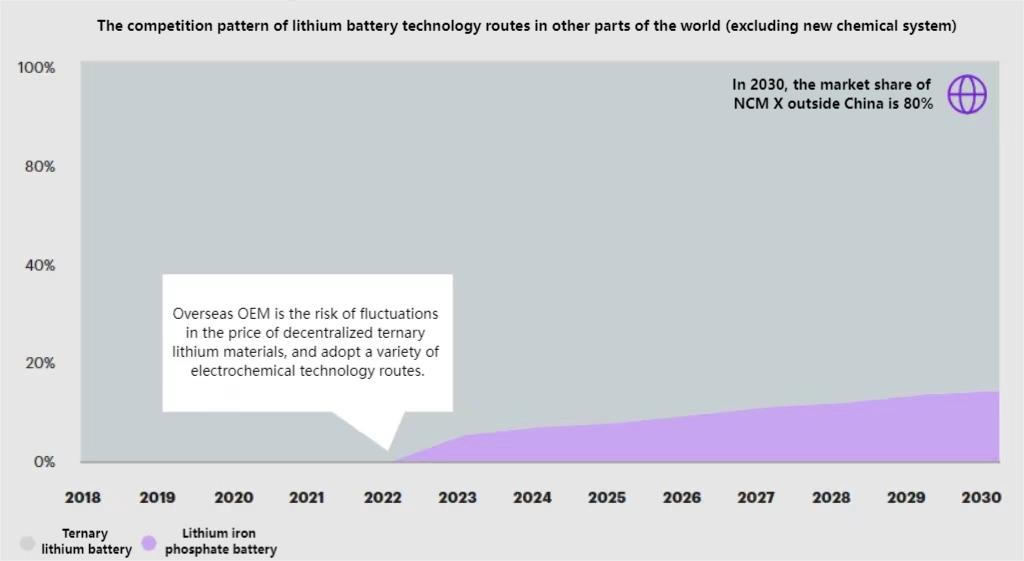

In the early days of the development of new energy vehicles, lithium iron phosphate batteries became the first choice due to the characteristics of high safety, low cost and long cycle life. In recent years, with the performance of the decline of the new energy vehicle subsidy, the performance of lithium iron phosphate battery packs, and the price of ternary lithium raw materials, the market share of lithium iron phosphate has exceeded the ternary lithium battery. In the future, performance upgrades and price fluctuations in raw materials will continue to affect the competition and market share of ternary lithium and lithium iron phosphate.

However, from a business perspective, although high -nickel, low cobalt three -dollar lithium battery has a unit mileage cost advantage, it still has high cost and uncertain development of nickel raw material costs and technological development. Maintain the purchase volume of lithium iron phosphate to decentralize the risk of large cost fluctuations caused by decentralized single -one technical route dependencies.

Lithium batteries are in the direction of high energy, high security, and low cost development, and with the fine differentiation of downstream application directions, different technical routes will show a diversified development trend.

To learn more about the lithium battery industry, stay tuned for more updates on the website or follow MK Energy’s social media accounts.