MENA Energy Storage Market Overview

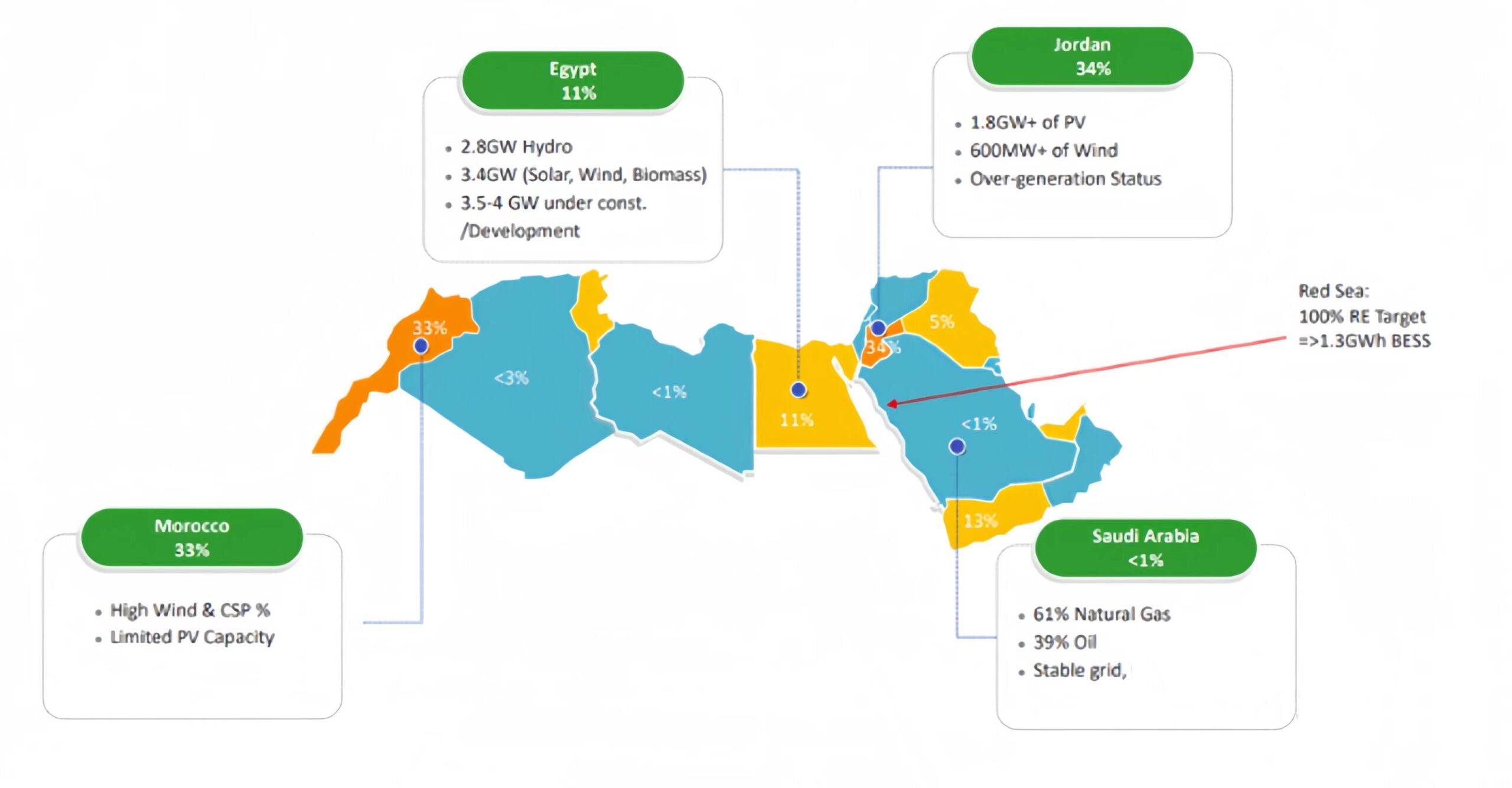

At present, the MENA renewable energy power generation market has begun to take shape. As of the end of 2022, Jordan’s operating photovoltaic and wind power generation is approximately 2.4GW (accounting for 34%), Morocco’s photovoltaic and wind power generation accounted for 33%, and Egypt’s renewable energy The installed power generation capacity + projects under construction are 10GW, and the energy storage installed capacity plan in the Saudi Red Sea region’s renewable energy plan has reached 1.3GWh.

Increased demand for off-grid/microgrid applications

MENA’s demand for off-grid/micro-grid energy storage applications is also gradually increasing. These applications are mainly reflected in three countries, Oman, Lebanon and Egypt. Among them,11 sites held by Armand Tanweer Energy Solutions have built a total of 48MW of photovoltaics, 70MW of diesel power generation, and are equipped with 28MW of energy storage projects. Regional microgrids in many areas of Lebanon use the photovoltaic + energy storage model. Egypt’s Sukari Gold Min is equipped with 36MW of photovoltaic and 7.5MW of energy storage systems.

Growth of user-side demand

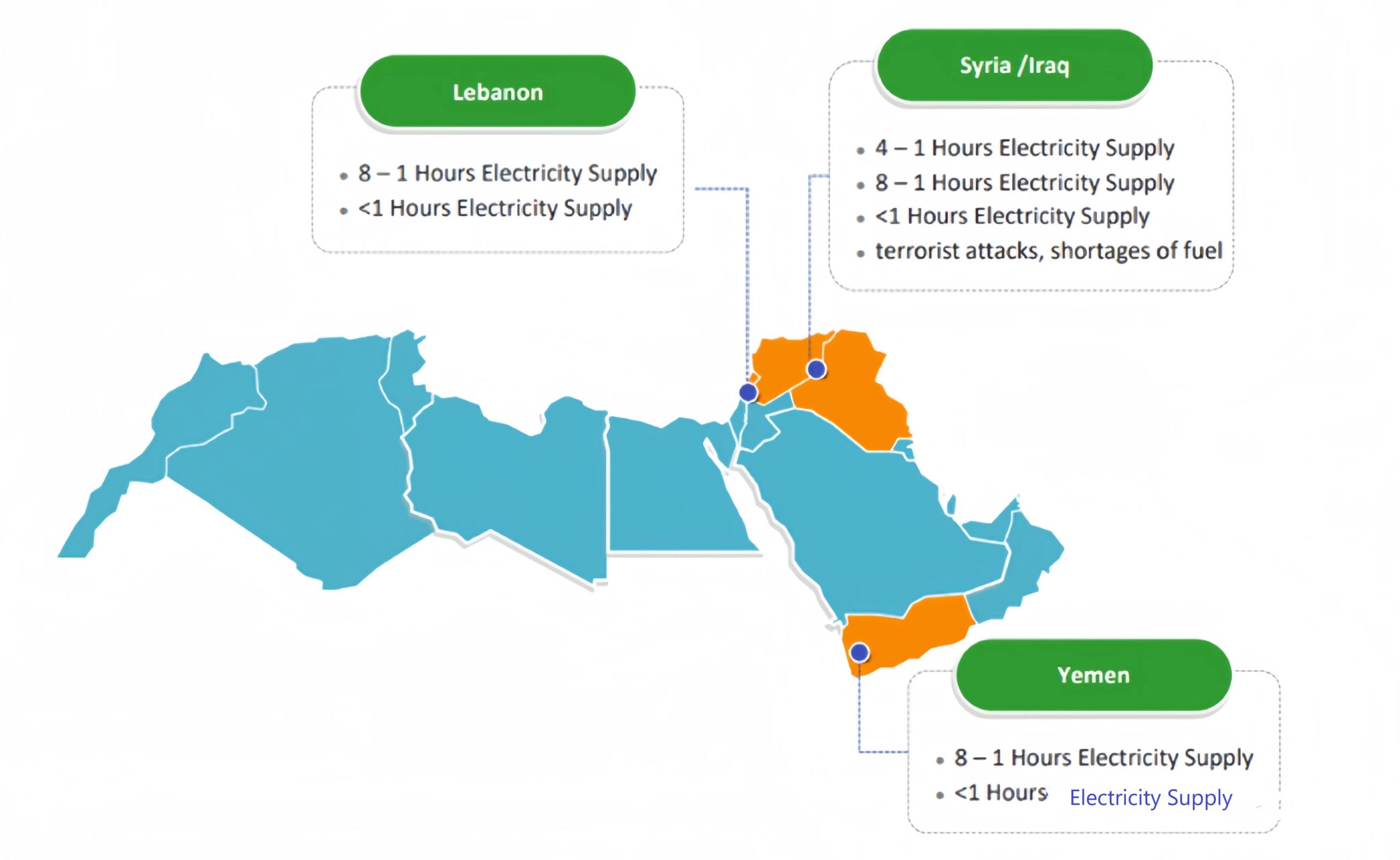

Due to geopolitical risks and other factors, the demand for user-side energy storage is concentrated in areas such as Lebanon, Yemen, Syria, and Iraq. These demands are concentrated in the backup power demand of less than 1h, and the direct power supply of 1h-4h or 1h-8h. need.

Due to geopolitical risks and other factors, the demand for user-side energy storage is concentrated in areas such as Lebanon, Yemen, Syria, and Iraq. These demands are concentrated in the backup power demand of less than 1h, and the direct power supply of 1h-4h or 1h-8h. need.

MENA household energy storage overview

For household energy storage, its net electricity usage is also called Net Metering (Net Metering), which is widely used in Egypt, Jordan and the United Arab Emirates. Normally, the electricity rates in these areas are uniform throughout the day, and the electricity purchase and sales costs are the same, but a small amount of grid fees will be charged. Therefore, the deployment of household energy storage systems in these areas is more for energy security and maximum Optimize the utilization rate of photovoltaic power generation.

Net Billing is used to a small extent in Saudi Arabia. The electricity fee in Saudi Arabia is 0.18 Riyal/kWh (the monthly fee for more than 6000kWh is 0.3 Riyal/kWh, the photovoltaic grid-connected electricity sales price is 0.07 Riyal/kWh, and the electricity fee is 0.07 Riyal/kWh throughout the day. The rates are uniform. Therefore, in Saudi Arabia, the deployment of household energy storage systems is mainly due to considerations of energy security and avoiding higher electricity bills.

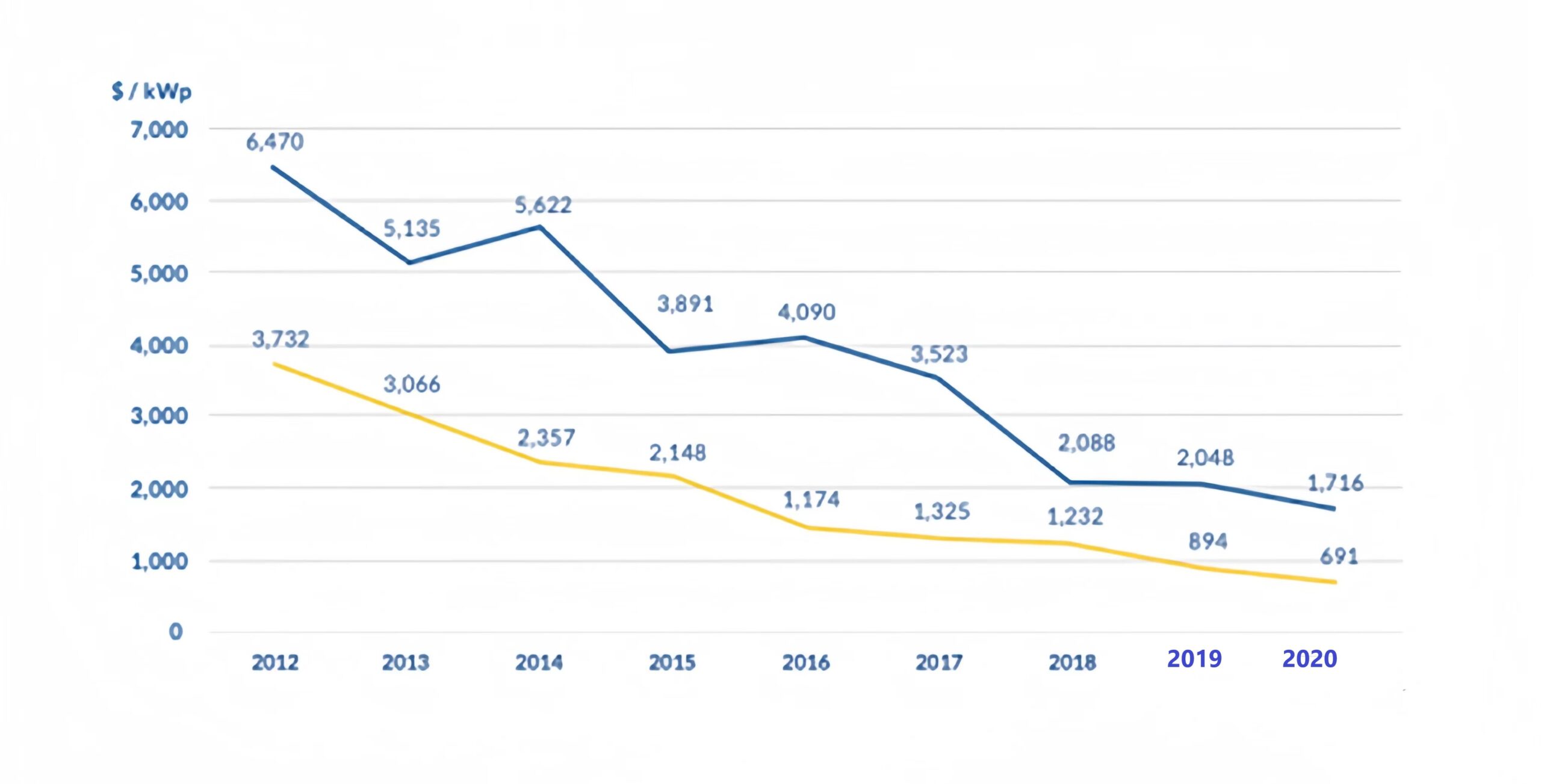

Taking Lebanon as an example, its photovoltaic distribution and storage rate has continued to rise as the price of its photovoltaic storage system has declined. In 2020, Lebanon’s photovoltaic distribution and storage rate reached 12%, with a total of 11,087kWp of photovoltaics equipped with energy storage systems.

Industrial and commercial energy storage

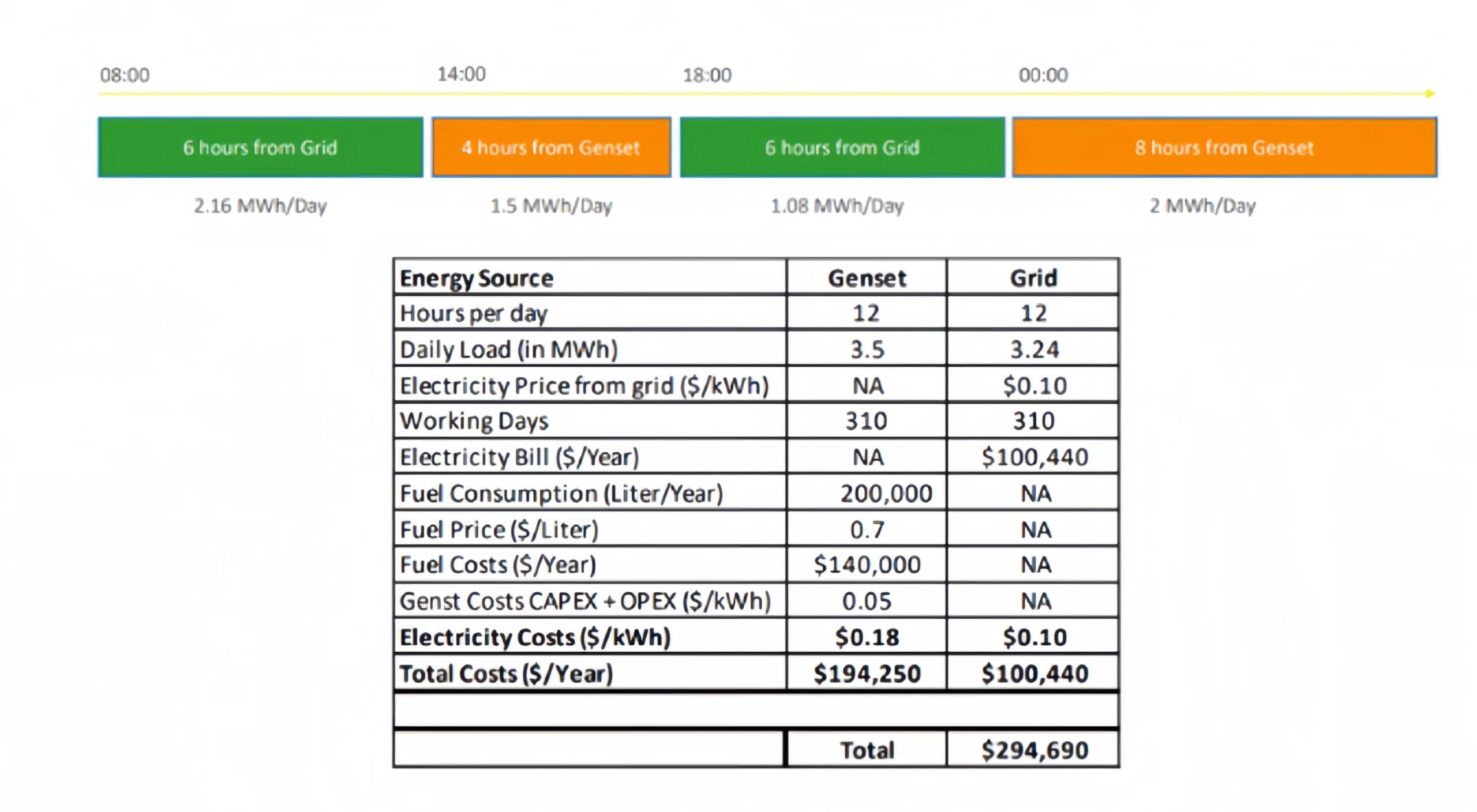

Taking the factory in Iraq as an example, when operating at full capacity, if a diesel generator is used for power supply, the cost is $294,690/year. If the diesel generator is replaced with a 1MW PM + 1MW/1MWh photovoltaic storage system, it can not only completely replace the Using a diesel generator for power supply can save $225,750/year based on an 8-year investment return period. Therefore, MENA’s industrial and commercial energy storage development has great potential.

For more industry updates, stay tuned for updates on the website or follow our social media accounts.