China’s BESS has grown strongly, which has attracted the attention of most countries. Below we analyze the reasons for this growth phenomenon from various aspects.

LFP market

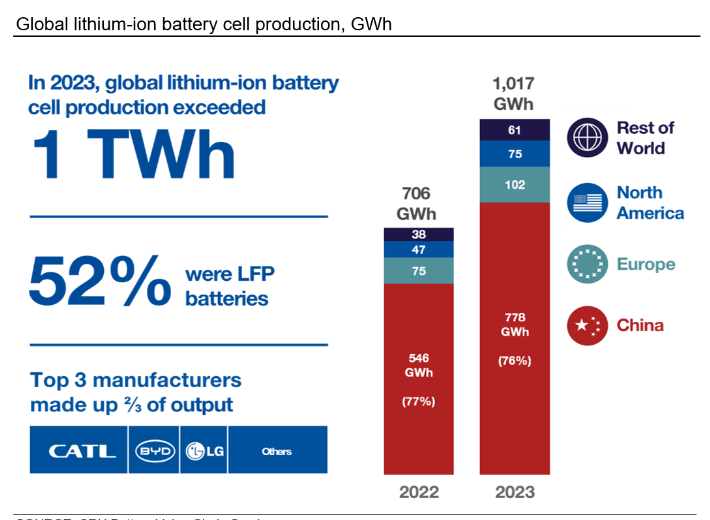

Global lithium-ion battery production will reach a record of 1TWh in 2023, 65GWh higher than actual demand. Most of these overcapacities occur in China’s LFP battery field. Chinese companies have successfully commercialized lithium iron phosphate (LFP) batteries for energy storage systems and are monopolizing the market with huge scale and ultra-low cost. Moreover, their market share in the electric vehicle (EV) field is growing, or the main type used in battery energy storage systems (BESS).

The influx of large amounts of investment has led to the gradual saturation of China’s LFP market, which has become more of an “oligopoly”. Large companies can use their brand effects to achieve rapid growth in production capacity, but for smaller companies, in order not to lose sales contracts, they can only sell battery materials at discounted prices and reduce losses caused by inventory backlog.

Reduced battery costs

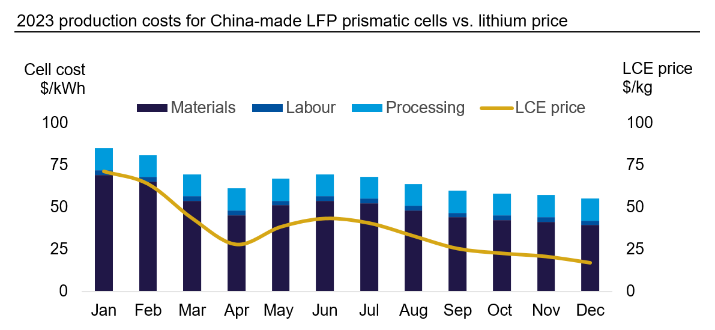

LFP’s cost advantage exacerbates overproduction. According to data from CRU Battery Value Chain service, the average production cost of China’s LFP batteries will drop significantly in 2023.

Reason

By 2023, lithium will account for 35% of LFP’s cost structure. The price of lithium carbonate falls and the cost of cathode decreases. After 15 months of rising prices, lithium prices rose to record highs, investment poured in, and oversupply in 2023 caused prices to fall.

From processing to graphite anodes to the yield rate of the super factory, Chinese factories improve production efficiency and compress the costs incurred in the manufacturing process as much as possible. Add to this the fact that battery makers are vertically integrated with lithium mining stakes, and China’s refineries are among the lowest-cost operations in the world. As a result, downstream companies pay less for lithium chemicals than their Western counterparts.

Will China monopolize the global BESS market?

Will China monopolize the global BESS market?

Chinese manufacturers may seek to shift rapidly growing inventories to export markets due to a lack of domestic orders, accumulation of inventory and capital expenditures at factories. This has less of an impact on the electric vehicle battery market, but it’s a completely different story for energy storage batteries. Energy storage batteries have completely different battery design and energy storage requirements than electric vehicles.

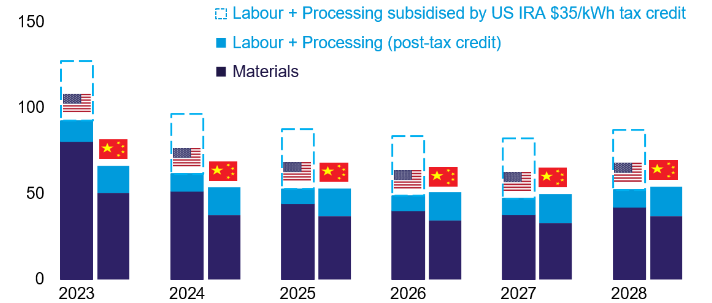

Although governments in many countries and regions have enacted anti-dumping duties and the high cost of importing lithium-ion batteries across regions, the low prices provided by China are still exciting. Western companies lack the knowledge to optimize production parameters, factory output has declined, and 50% losses are common in early operations. Superimposed on rising labor and electricity prices, Western LFP battery manufacturing costs do not occupy a market advantage compared with China.

Until now, China has dominated the supply of LFP cathodes, and most Western LFP cell manufacturers have relied on China for battery materials and other components. Subsidies can only improve cost competitiveness with China in the short term, but this approach is short-term.

According to the CRU Battery Value Chain service, 200GWh of LFP cells for energy storage are expected to be produced in 2023. Although actual demand is only 135GWh, this number is still more than double that in 2022, consistent with the unprecedented growth of the photovoltaic industry.

While batteries are only one component of the total cost of an energy storage system, low battery prices are good news for BESS installers and will have a positive impact on demand. Without enough funding for innovation and disruptive manufacturing processes, Chinese companies are likely to squeeze their competitors out of the battery storage market.

For more industry news, please continue to pay attention to our updates or follow our social media accounts.