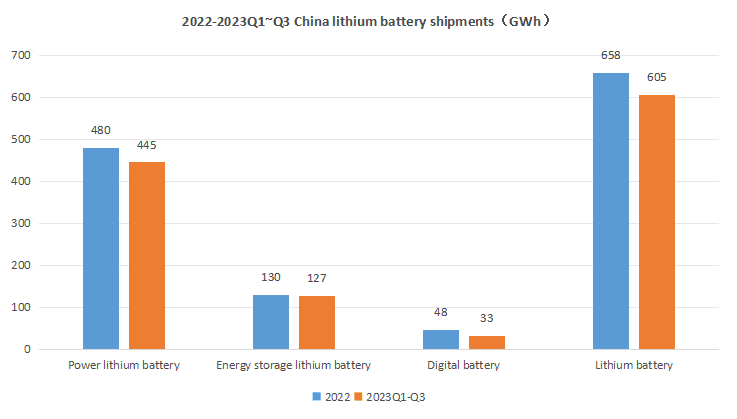

According to China Lithium Battery Research Data, China’s lithium battery shipments in the first three quarters of 2023 were 605GWh, a year-on-year increase of 34%, which is close to the full-year 2022 level. Specifically, look at the product segments:

The growth rate of power batteries has declined sharply, energy storage batteries have the fastest growth rate, and digital batteries continue to shrink.

Power batteries: China’s power battery shipments were 445GWh, a year-on-year increase of 35%, and the growth rate dropped sharply from the same period last year. Data from the China Automobile Association shows that from January to September 2023, China’s new energy vehicle sales were 6.278 million units, a year-on-year increase of 37.5%. The main reasons why the growth rate of power battery shipments is lower than the growth rate of new energy vehicle sales are as follows:

(1) The proportion of Plug-in Hybrid Electric vehicle (PHEV) increased by 7 percentage points. From January to September, plug-in hybrid new energy vehicles accounted for 28.8% of the total number of new energy vehicles in China, an increase of 7 percentage points from the same period last year. Plug-in hybrid electric bicycles accounted for 30KWh less than pure electric bicycles;

(2) Inventories have surged under high lithium salt prices. Data shows that the lithium battery consumption inventory will reach 130-150GWh in the first half of 2023.

Energy storage batteries: Driven by the growth of the power energy storage and industrial and commercial energy storage markets, China’s energy storage lithium battery shipments in the first three quarters of 2023 were 127GWh, a year-on-year increase of 44%. Among them, Q3 shipments were approximately 40GWh, down more than 10% from the previous quarter.

The main reasons are: The installation of power storage in the United States has been postponed, and overseas market demand has weakened; The price of lithium salt in China continues to decline, and end customers are more cautious in placing orders to reduce losses.

Digital battery: China’s digital battery shipments in the first three quarters of 2023 were 33GWh, a year-on-year decrease of about 6%. Amid increasing macroeconomic downward pressure, consumer demand for major 3C digital products continues to be weak, resulting in 3C soft-pack digital, electric Shipments in the tool and lithium battery two-wheeler markets declined.

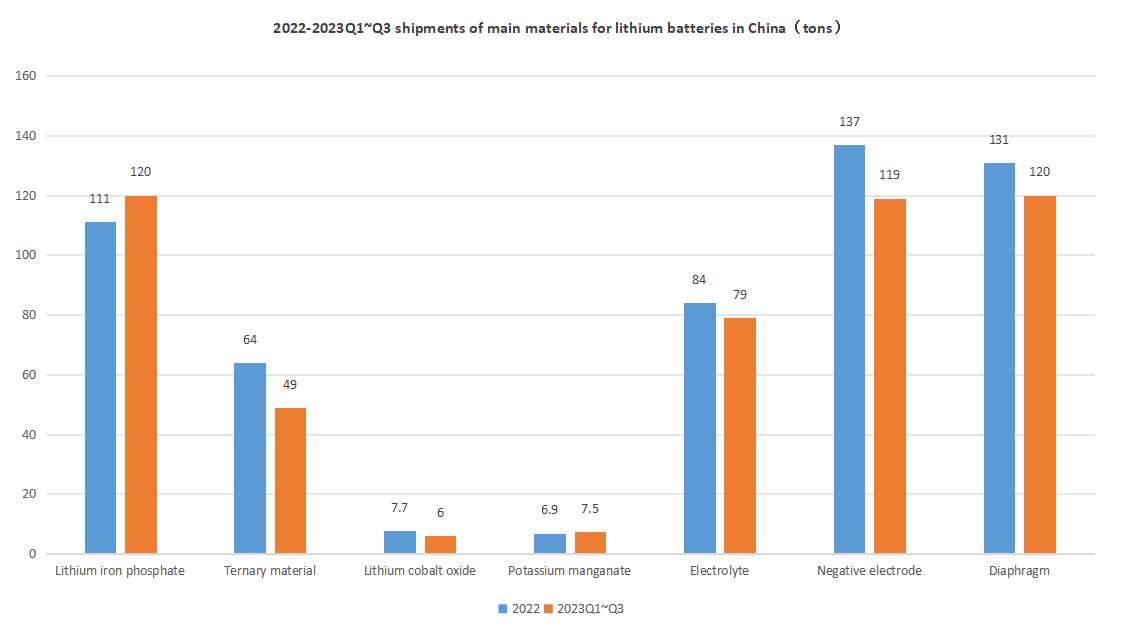

The shipment growth rate of cathode and electrolyte materials led the four major materials, both reaching 40%.

Data show that China’s cathode material shipments in the first three quarters of 2023 were 1.82 million tons, a year-on-year increase of 40%. Among them, lithium iron phosphate shipped 1.2 million tons, a year-on-year increase of 64%. In the first three quarters, lithium iron phosphate batteries accounted for more than 70%, driving the continued rapid growth of lithium iron phosphate cathode material shipments.

In terms of anode materials, China’s anode material shipments in the first three quarters of 2023 were 1.19 million tons, a year-on-year increase of 25%.

In terms of electrolyte, China’s electrolyte shipments in the first three quarters were 786,000 tons, a year-on-year increase of more than 40%. High lithium salt prices have also affected the overall profitability of the electrolyte industry. With the stabilization of lithium salt prices in the fourth quarter, and LiFSI and other The proportion of high-value products in new lithium-ion batteries has increased, and the profitability of companies in the industry is expected to improve significantly in the fourth quarter.

In terms of lithium battery separators, China’s lithium battery separator shipments in the first three quarters were 12 billion square meters, a year-on-year increase of 30%. Among them, dry-process separators shipped 3.3 billion square meters and wet-process separators shipped 8.7 billion square meters, a year-on-year increase of 55% and 31% respectively. The demand for dry-process separators grew faster than that of wet-process separators, mainly due to the energy storage market’s demand for dry-process separators. Due to the popularity of the product.

For more industry news, please always follow our official website or social media accounts.