Renewable energy deployment in Southeast Asian countries has become a rigid demand

According to the International Energy Agency (IEA), the GDP of Southeast Asian countries has doubled since the beginning of this century. At the same time, energy demand is increasing by about 3% annually. In line with the Paris Agreement goals, six countries in the ASEAN region have committed to achieving net zero targets in the future. Southeast Asian countries must deploy about 21GW of renewable energy annually by 2030, with wind and solar photovoltaics accounting for 18% of electricity generation, reaching 44% by 2050.

Philippines: “Privatization + Free Competition,” the energy storage potential of the power market has doubled

*Currently,70% of the electricity in the Philippines relies on fossil energy. However, fossil resources are scarce and are mainly imported from Indonesia, Australia, etc., so electricity resources are in short supply. In addition, the Philippines has a total of 7,101 islands. Frequent natural disasters such as typhoons prevent remote islands from connecting to the power grid. Therefore, the Philippine power supply market has become an urgent need for energy storage.

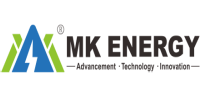

*At present, the cost of electricity in the Philippines is high. The average electricity price for residents in December 2022 is as high as US$0.18/KWh. There is also a serious power shortage in the country, and the demand for energy storage is imminent. According to the Philippine National Power Development Plan, the Philippines will accelerate the construction of renewable energy in the future and is expected to configure 6GW of energy storage.

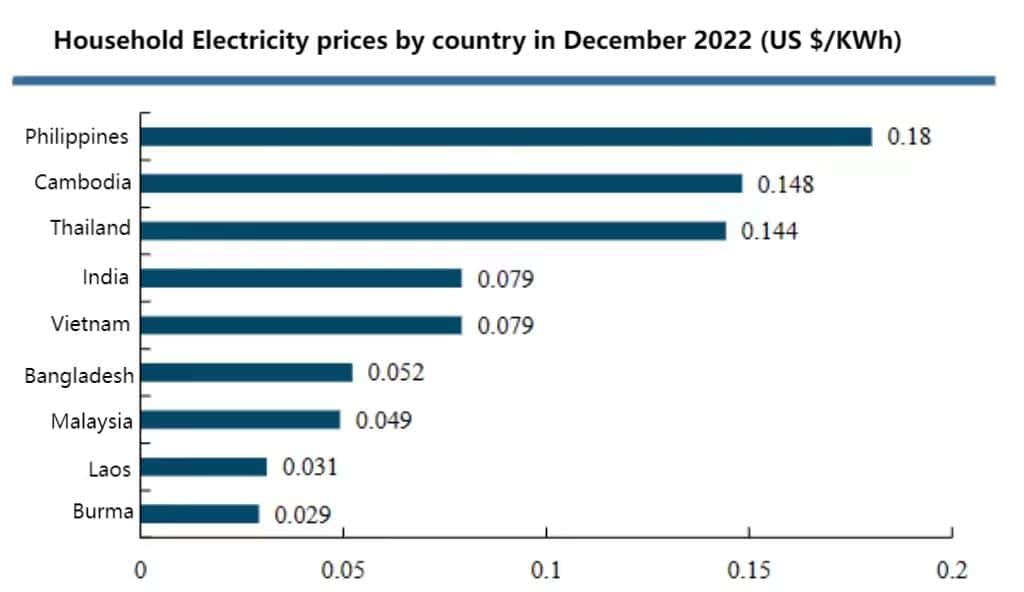

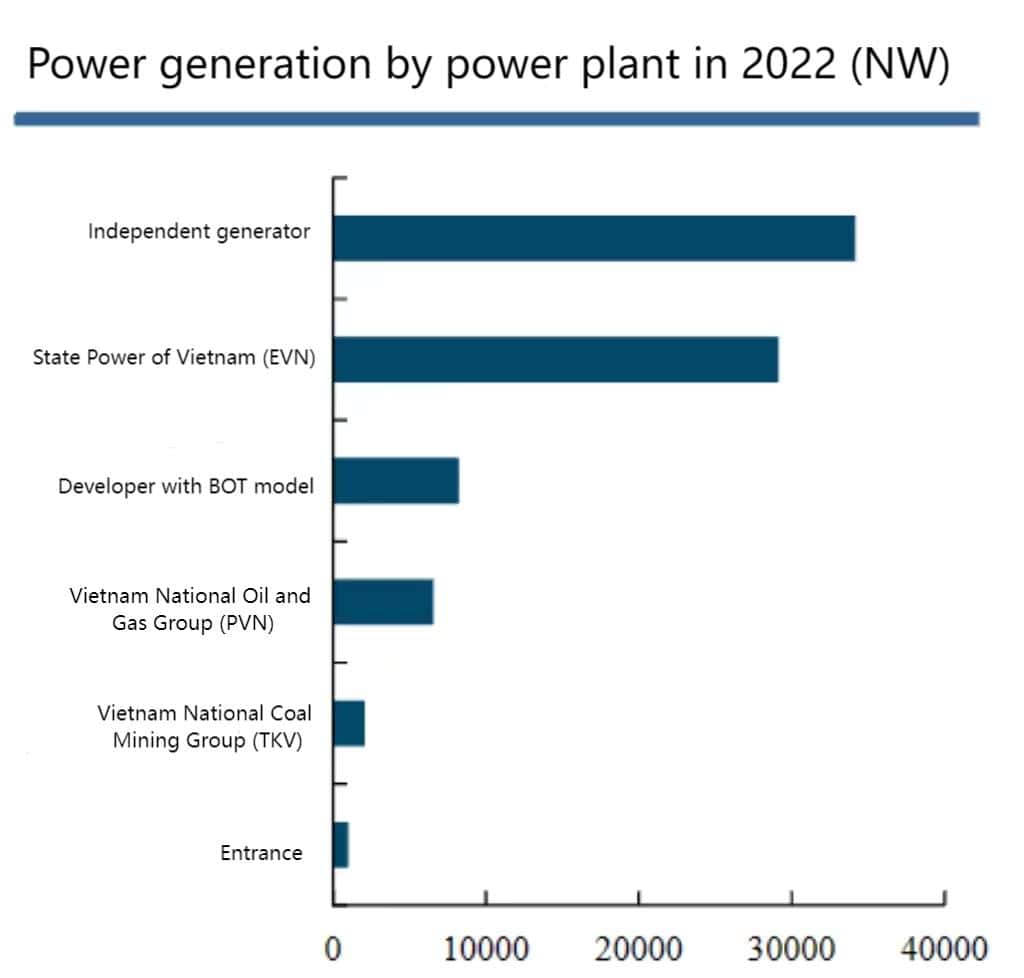

Vietnam: South power cannot be transferred north, creating energy storage opportunities

*Hydropower and coal power are relatively developed in northern Vietnam, and power types are diversified. However, hydropower stations in the north will almost dry up in 2023. The average dispatch will be reduced by 50% compared to 2022, accounting for about 12%-15% of power generation, while the remaining water in the south will be based on the peak The electricity consumption standard is only enough for four days. Secondly,48% of the coal-fired power plants in the north continue to operate due to high temperatures, and their machine capacity is reduced. As a result, the power supply in the north exceeds demand, and production is suspended. In the future, energy storage needs will be put on the agenda.

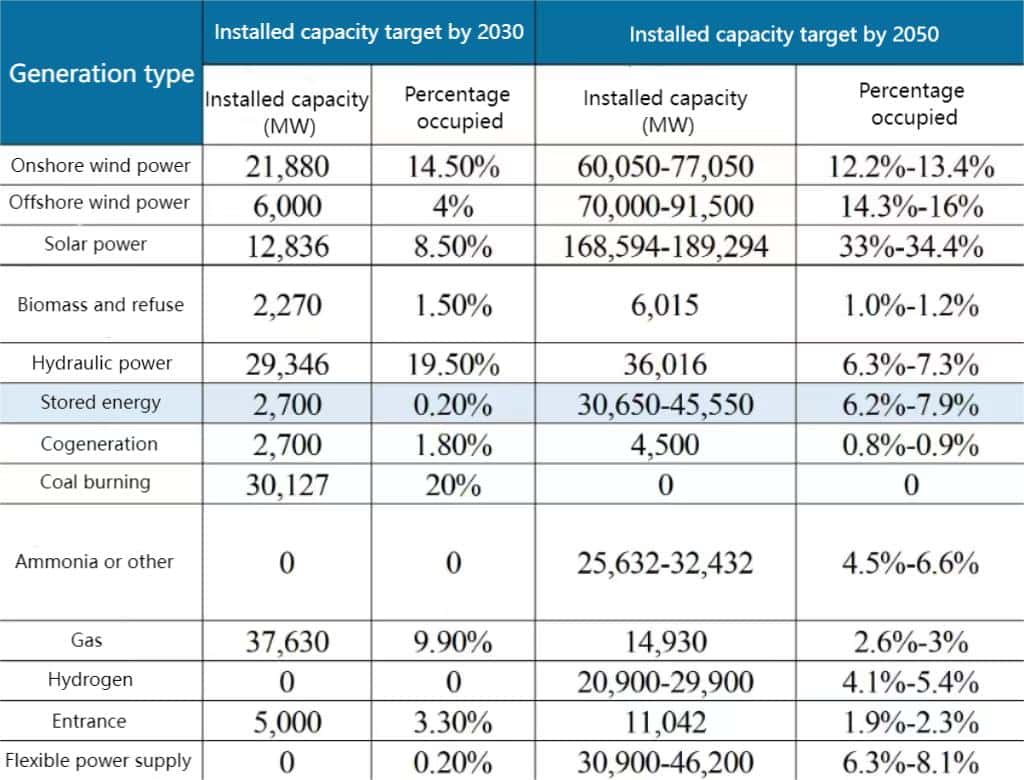

*In May 2023, Vietnam released the Eighth Power Development Plan (PDP8), intending to stop the development of new coal power projects by 2030 and the use of coal-fired power generation by 2050. By 2030, Vietnam’s photovoltaic power stations will increase to 12GW, and energy storage will increase to 2.7GW.

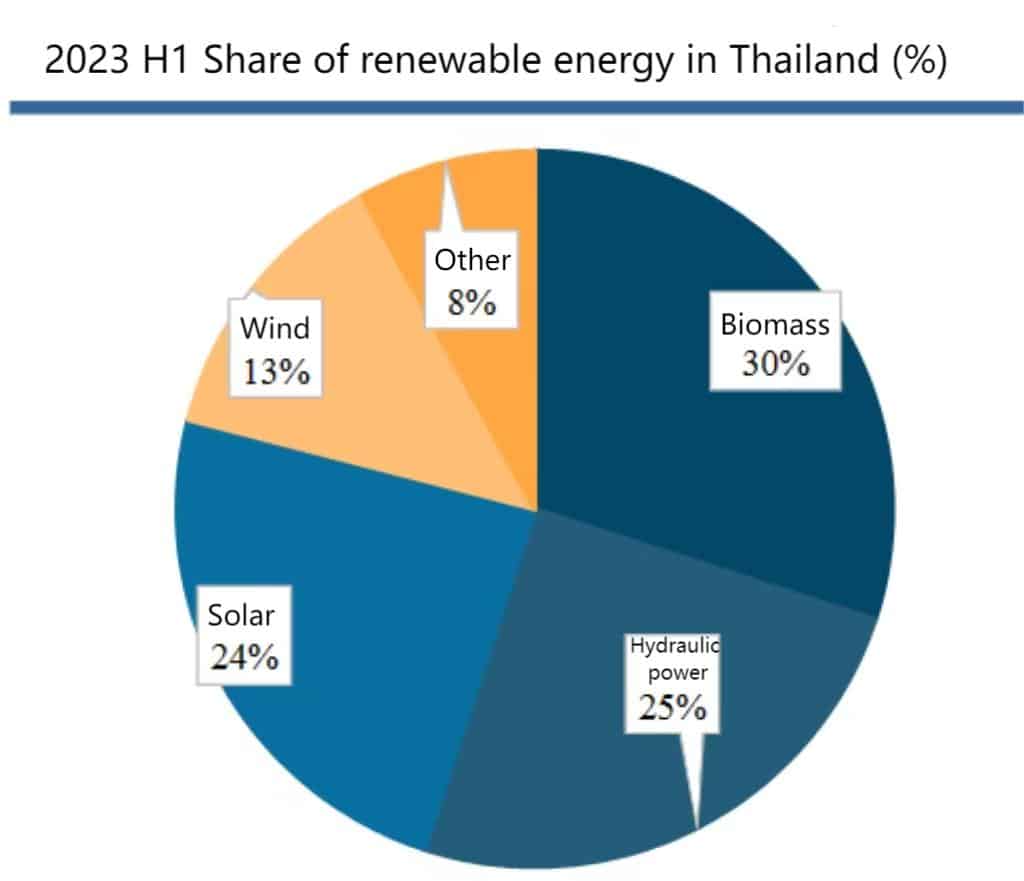

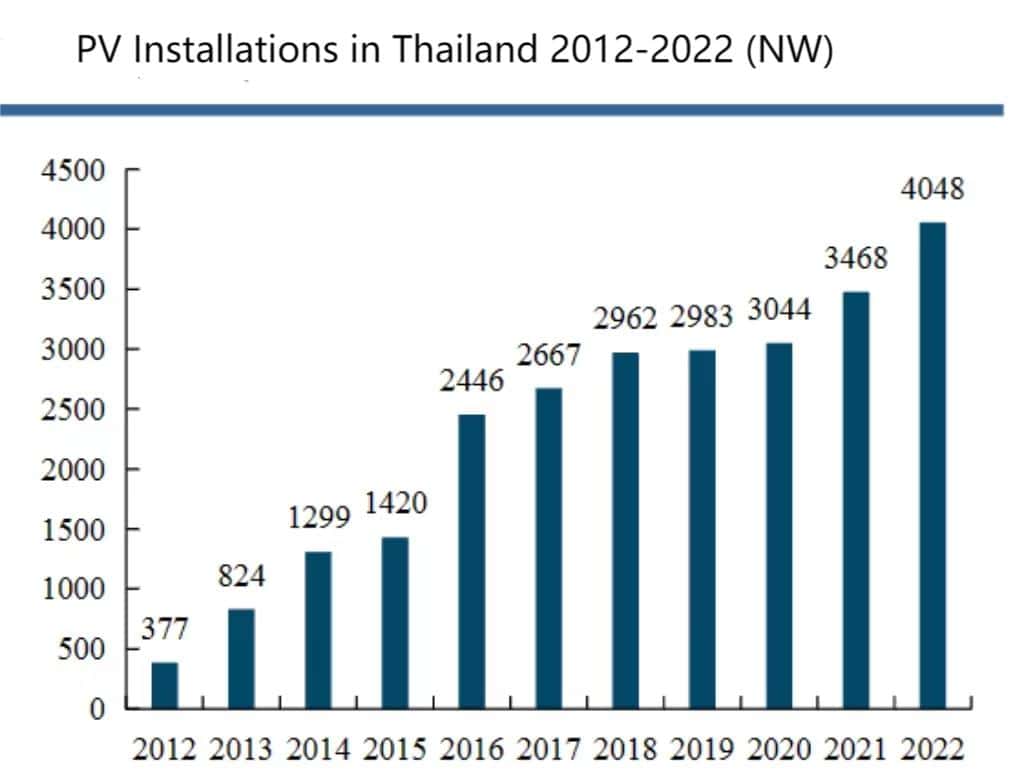

Thailand: Scenic and solar planning will inevitably drive energy storage demand

*According to 2018 Global Energy Team data, Thailand has insufficient natural gas reserves, poor coal quality, and a significant gap in electricity demand, with about 13% relying on imports. Therefore, the electricity price is around US$0.12/kWh, which is relatively high among Southeast Asian countries.

*Southern Thailand is rich in wind resources, but the most developed power grid area is in the central Bangkok economic circle, and the connection with the southern power grid is weak. If wind power is to be vigorously developed, energy storage is the only way to solve the problem of the south of power grid.