In the global landscape of energy storage, Europe shines as a bright beacon of innovation and progress. From individual storage solutions in households to massive grid-scale projects, Europe is at the forefront of revolutionizing how we generate, consume, and store energy, playing a pivotal role in shaping the world’s energy future.

We will introduce the European energy storage market from the following aspects:Household storage, Large storage, Driving force, Future outlook.

Household storage

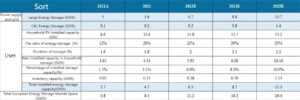

New installed capacity in 2022 will be 5.7GWh,147.6%year-on-year

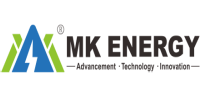

According to data from the European Photovoltaic Association and EV tank, in 2022, the newly installed capacity of household storage in Europe will be approximately 5.7GWh, +147.6% year-on-year; the cumulative installed capacity will be 11.1GWh, +105.2% year-on-year. Germany, Italy, the United Kingdom, and Austria ranked the top four markets with 1.54GWh,1.1GWh,0.29GWh, and 0.22GWh respectively.

As the two countries with the largest household storage installed capacity in Europe, Germany and Italy will account for more than 50% of the total installed capacity in 2022. Among them, Germany will have more than 1GW of household storage installed capacity, and more than 200,000 households will choose to install household energy storage systems in 2022;

Italy The installed capacity of household storage exceeds 500MW, but with the gradual reduction of the Superbonus subsidy policy (completely phased out in 2026), the demand for household storage in Italy will gradually weaken in the future.

Germany’s stock market is the main force, and Italy’s growth is catching up.

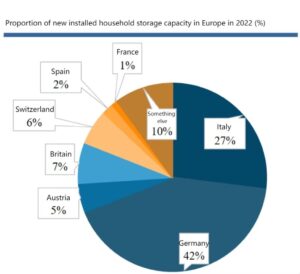

Germany: According to data released by ISEA&RWTH, Germany’s household storage installed capacity will be 1839MWh in 2022, +49.9% year-on-year. In 2023Q1, the installed capacity of household storage was 976MWh, a year-on-year increase of 156.2%.

Among them, the installed capacity of household energy storage in March was 343MWh, +118.5% year-on-year, and +18.7% month-on-month; the installed capacity in April was 218MWh, +62.7% year-on-year, and -36.4% month-on-month. The high prosperity of Germany’s household savings market is due to “higher electricity prices + incentive policies.”

Italy: According to ANIE Federazione, Italy’s household energy storage installed capacity will be 2.0GWh in 2022, +384.7% year-on-year. The new increase surpasses Germany and ranks first in Europe, mainly due to “tax exemptions + credit sales”.

However, a new law was introduced in February 2023. It is expected that the 110% excess subsidy for individual households will be postponed from March this year to the end of September. Credit support will weaken, and the installation situation in 2023 remains to be seen.

Large storage

The 2GW large storage capacity will begin to take shape in 2022, and multi-country planning will drive future volume growth

As the cost of photovoltaic storage decreases in 2023, ground photovoltaics and large-scale storage in Europe will gradually open up the market, and the project scale of energy storage projects will continue to increase. The European large storage market has begun to take shape.

According to data from the European Energy Storage Association (EASE), Europe’s newly installed energy storage capacity will be approximately 4.5GW in 2022, of which large storage capacity will be 2GW, accounting for 44% of the power scale.

From the perspective of the installed capacity of energy storage in front of the meter, the UK market accounts for 42%, leading the European large storage market. Ireland, Germany, and France account for 16%,12%, and 11% of installed capacity respectively. EASE predicts that new large energy storage capacity in Europe will be at least 3.5GW in 2023.

Energy storage trends in major European storage markets in recent years:

Europe: On July 19,2023, the European Parliament passed the power reform plan to encourage the introduction of more non-fossil fuel flexible resources into the power grid and improve investment returns through capacity markets and other methods.

Britain: In 2020, the 50MW capacity limit for a single battery energy storage project will be officially lifted, significantly shortening the approval cycle for large storage, and at the same time canceling the dual charging mechanism for energy storage on the generation/consumption side.

Italy: Regulators approve new grid-scale energy storage auction rules. 800-900MW energy storage will be deployed in 2023-2024, second only to the UK in scale.

Spain: The government plans to fund 160 million euros to deploy 600MW energy storage projects that will be connected to the grid in 2026. State aid of 280 million euros will be launched in July 2023 to support independent energy storage projects and pumped storage hydropower projects.

Germany:In 2020, the “innovative bidding” was launched for the first time to assist the implementation of energy storage and other renewable energy projects.

Greece: A large-scale battery storage auction has been approved by Greek regulators. The independent energy storage procurement process will start in Q3 2023, and the system will be completed by the end of 2025.

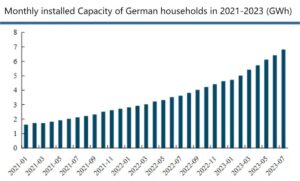

According to Wood Mackenzie’s forecast, by 2031, the cumulative installed capacity of European large storage capacity will reach 42GW/89GWh, with the United Kingdom, Italy, Germany, Spain and other countries leading the large storage market. The growth of renewable energy installed capacity and the gradual improvement of revenue models are driving the development of large-scale storage in Europe.

The UK leads the large-scale storage market, followed by Germany’s small-scale deployment

United Kingdom: According to British officials, as of January 2023, the United Kingdom has 42 energy storage projects of 10MW and above in operation, with a scale of 1.2GW;38are under construction, with a scale of 1.9GW; and 419 planned projects, with a scale of 25.4GW. In 2021, the UK’s annual installed capacity will be 617MWh, reaching 569MW/789MWh in 2022, a year-on-year increase of 27.9%.

Germany: According to ISEA&RWTH data, in 2022, Germany’s large-scale energy storage capacity will be 464MWh, of which 251MWh was put into operation in December, accounting for 54%. In 2023Q1,58.0MWh of large-scale energy storage and 31.5MWh of industrial and commercial energy storage were put into operation; the current planned large-scale energy storage capacity is 350MWh.

Driving force

Energy shortage and gas-to-coal conversion issues will increase the demand for wind and solar power generation

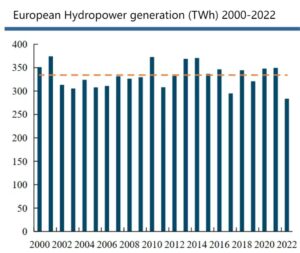

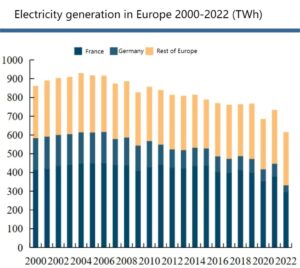

In 2022, Europe is facing a severe drought, and hydropower generation has dropped to 283TWh, the lowest level since 2000, a year-on-year decrease of 19%. Secondly, nuclear power generation was 119TWh, a year-on-year decrease of 16%, of which 69% was due to power outages in France and 27% was due to German nuclear power plants.

Among them, after the shutdown of units in December 2021, Germany’s nuclear power generation capacity decreased from 69 TWh in 2021 to 37 TWh in 2022, and is expected to be offline in April 2023. In addition, France is the largest electricity exporter in European history. But for the first time since 2000, France became a net importer.

Since Russia first began restricting gas flows to Europe in July 2021, gas prices have been significantly higher than coal prices. This has led to a switch from natural gas to hard coal power generation in 2021. Europe’s goal of reaching 42.5% of renewable energy by 2030 remains unchanged, so it will increase its reliance on wind and solar power.

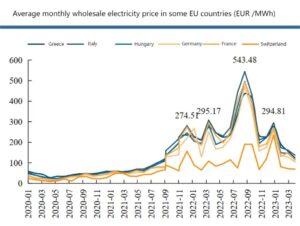

Electricity prices remain higher than before the energy crisis, fundamentals continue

Currently, with the decline in natural gas prices, wholesale electricity prices in Europe have temporarily fallen. But supply and demand cannot keep natural gas prices low for long. In order to limit the uncontrolled rise in electricity prices and respond to the energy crisis, the European Union issued an emergency intervention energy price plan in September 2022, which will impose a windfall profit tax on energy companies.

The specific implementation plan will be decided by each member state. As of December 2022,16countries and regions in Europe have promoted windfall profit tax collection policies.

According to HEPI data, electricity prices for newly contracted residents in many European countries showed a downward trend in April 2023, with Denmark falling by more than 30% month-on-month, and Germany and Spain falling by more than 5% month-on-month.

In absolute terms, the United Kingdom and Ireland are still higher than 0.45 euros/kWh, and Germany, the Czech Republic, and Italy are still higher than 0.4 euros/kWh. Electricity prices are still higher than the same period in April 2021 before the Russia-Ukraine conflict. The fundamentals of electricity have not yet Completely improved.

Future outlook

The installed capacity will reach 11.3GWh in 2023, and the CAGR will reach 53% from 2021 to 2025.

After Russia restricted gas supplies in 2021, Europe began switching from gas to coal. At present, electricity prices in many European countries are still higher than before the Russia-Ukraine conflict, and the fundamentals of electricity have not improved.

Europe, as a mature market for household savings, will remain hot. In addition, the power supply levels of European hydropower vary greatly between dry and wet periods, and the dependence on wind and solar power generation is gradually increasing.

The large-scale storage market will have an installed capacity of 2GW in 2022, which has begun to take shape; in July 2023, after the European power reform plan is passed, the large-scale storage market will have the momentum to start volume. From 2023 to 2025, the newly installed energy storage capacity will reach 11.3GWh,18.3GWh, and 26.4GWh.

Share the article on your social network and click Follow us for more market updates.